“Let’s say you want to build muscles, and it’s suggested that you change your diet; eat fruits, vegetables, etc.

How does that support you to build muscles? It doesn’t. Until you lift weights you will not gain muscle. Dieting and building muscles are two different functions of your body.

Therefore, paying off credit card debt is like dieting – it will not build the assets that will allow you to create wealth. Later in life you end up with no debt, but you also have no assets.”

Rennie Gabriel

This is an important lesson our recent guest, Rennie Gabriel learned. Despite education in, and a career as, a financial planner, Rennie became financially broke at the age of 50.

“I was not taught the foundations of handling money effectively, which is sad. Ninety percent of the population has not received the right information about money.”

Rennie Gabriel

How has this happened?

“Parents and teachers can’t teach what they don’t know. I’ve asked hundreds of Certified Public Accountants, and not one has said budgeting and handling money was part of their course work. It wasn’t included in my course work as a financial planner.”

Rennie Gabriel

Rennie explains financial planners are taught to help wealthy people stay wealthy, but not how to create wealth. Rennie says the first place to start creating wealth is with our attitudes, beliefs, and values.

There are some beliefs which hold us back. These beliefs keep us stuck in the same old rut of living from paycheck to paycheck, choosing which bills we can pay this month, and being concerned about impressing strangers.

“There is a myth which says you have to pay off your credit cards before you can start saving or investing in yourself.”

Rennie Gabriel

Once Rennie knew the secrets, he paid the minimum payments on his debt, and he saved money while doing so. In three years, he’d saved $18,000. He used that to start an investment portfolio with two other people.

“Anyone who lives on 80% of what they earn will be able to create wealth. Ten percent saved for later, and ten percent kept for the rest of their life. That’s the money used to build wealth.”

Rennie Gabriel

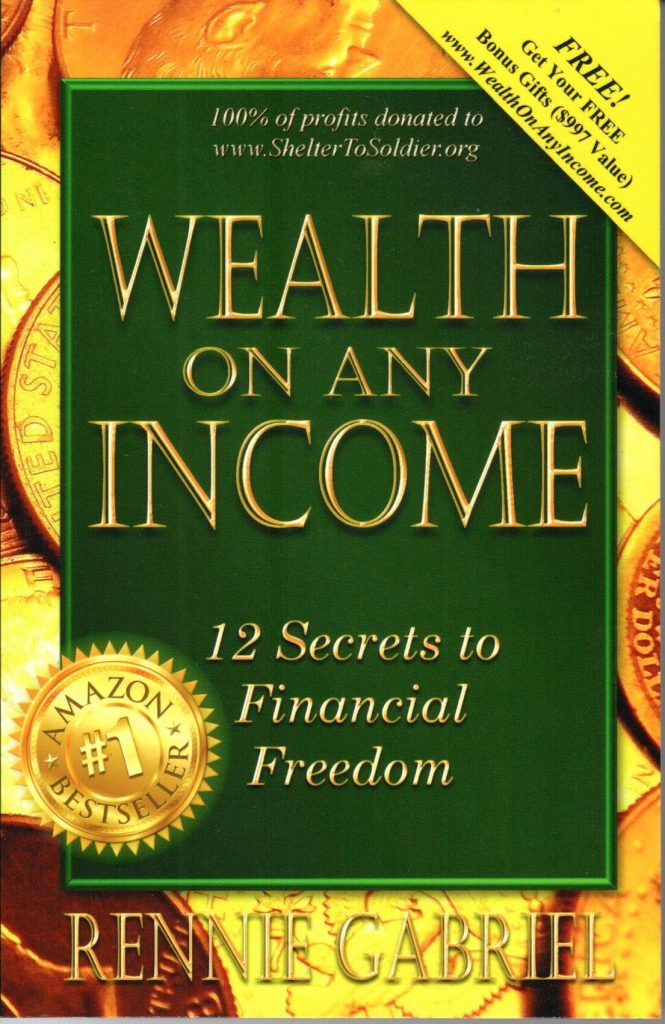

In his book, Wealthy on Any Income – 12 Secrets to Financial Freedom, Rennie covers some false beliefs you and I are likely to have:

Thought/Belief #1

More money will buy the happiness I’m missing now.

Thought/Belief #2

Budgets and spending plans are the same thing.

Thought/Belief #3

If I just made more money, I wouldn’t need a spending plan or budget.

Thought/Belief #4

This will take too much time and restrict my spending.

Thought/Belief #5

Setting up a spending plan will be too complicated.

Thought/Belief #6

Rich people don’t have to do this. I shouldn’t have too either.

Because of his wealth now, Rennie can give more money to causes he believes in. He gives all the proceeds of his book and programs to a nonprofit called Shelter to Soldier.

“They take dogs from environments where they could die on the street, or in a shelter where they could be euthanized, and they are trained as service animals for soldiers who’ve returned from service with PTSD, traumatic brain injuries, or other issues. Suicide rates among our returning military personnel is almost one an hour – 22 a day.”

Rennie Gabriel

Not one soldier who has received a service dog has committed suicide, yet thousands of dogs a day are euthanized.

Rennie describes a few ways dogs can help:

- Someone with PTSD can start to get uncomfortable in a crowd, and his/her service dog can sense this and take the soldier out of the situation.

- A soldier could be having night terrors, and their service dog will jump on the bed and wake them up.

- These dogs can turn on light switches, open doors, and whatever else the veteran needs.

Quick Links to our Social Media Sites